Market Update - March 22, 2020

Nicole Rothe - Jun 04, 2021

Market Update - March 22, 2020

What has been going on in the markets since my last update? It has been more of everything I discussed in my previous updates. We have continued to see a yo-yo in volatility as COVID-19 virus numbers increase across the globe.

Many countries have taken steps to increase social distancing measures, with more effected countries/states (in the US) even issuing country-wide or state-wide lockdown orders. Yes, these measures will increase unemployment numbers and hurt the economy, however, central banks and governments have continued to announce measures to support the economy throughout this time of uncertainty. Many economists are hopeful that these measures will soften economic fallout and assist in a swifter recovery, however, until we have more answers regarding COVID-19 and whether our social distancing efforts have been successful, we will probably continue to see volatility.

Bond Markets – Why have they been volatile?

For those of you who have a balanced portfolio, or are conservative investors, you will be holding bond portfolios or portfolios that hold fixed income. Usually, these types of funds are not as correlated to the equity markets and during market volatility will be protective. However, as we have seen during this period of market volatility, this has not necessarily been the case. At this time bond markets are still vastly outperforming equity markets, but they have seen have not been immune to volatility for a few reasons:

- Usually, when there is volatility in the market, investors will pile into bonds from equities for safety, however as I’ve mentioned in previous updates, this market sell off is very much fear-based so people have been panic selling which has led to volatility in the bond market as well as the equity market.

- Bond prices usually move inversely to interest rates. Typically, when interest rates are high, bond prices are low and vise versa. As governments have cut interest rates, these bonds become more expensive because existing bonds are now paying a higher interest rate than new bonds. When the market plunges, investors will buy Treasury bonds to provide safety, however, this pushes bond prices up even further and decreases bond yields increasing volatility

As the US government continues to provide stimulus to the bond market by purchasing treasuries, it is possible that an increase bond yield could be seen.

Some of you reached out after my last update asking what you can and should do right now:

As I have said in both of my past updates, the worst thing you can do is panic. The decisions we make now, and during a future recovery will help you achieve your goals in the long run. Keeping a disciplined investment approach and re-balancing once volume in the market slows down will help recovery once this is over. Usually, when we look at market downturns historically, the bottom (lowest point) occurs around the time that public sentiment is at its worst. This may occur when the US and Canada see their peak virus cases and may not be too far off.

It is important to remember that some of the best market days for recovery are often seen between or right after a large negative day, so it is important to see these days for portfolio recovery.

What measures can we take to assist in portfolio recovery? Expanding on some points mentioned in the previous market update.

- Rebalance: Why is this actually important? As mentioned in my previous update, when the volume in the market slows and we believe a bottom is near, I will be contacting those of you who’s portfolios would benefit from re-balancing after this downturn. Re-balancing portfolios can assist in faster recovery.

- For example: If you had a portfolio that was 60% equity and 40% fixed income, after this market downturn it may look more like 40% fixed income and 60% equity. If we were to leave your accounts as is, recovery would be more difficult because fixed income will not have the same growth as equities will. If we meet and rebalance your portfolio, recovery can be easier and quicker.

It is important that we do re-balance when the time is right, otherwise, your recovery could be a longer journey. Trading volume has already started to decrease over the last week, which may be a good sign, however influx of bad news could create an increase in volume again. Regular contact and portfolio reviews are done for your benefit and can only help your investments in the long run.

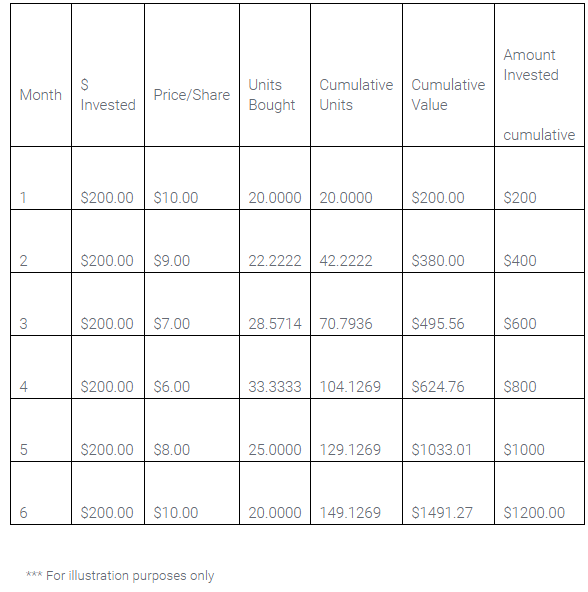

- Dollar-Cost Averaging: Why does this help? If you are contributing on a monthly basis right now and have ample emergency funds and job security, do not stop. Continuing with this behaviour will reward you in the long run. For those of you who have extra money in your budget and good job security during this time, you may want to think about starting to contribute on a monthly or bi-weekly basis. You may be thinking – but why would I buy when the market is dropping? Well – if you are buying right now, you are buying things on sale. When the market starts to recover you will see more growth on these funds because they didn’t fall as much in the first place. This will also aid in your portfolio recovery. I have put together a small chart to explain how this may work.

You can see that once the market recovers and price per share increases that the cumulative value of your deposits will outweigh the cumulative invested amount, this will help accounts bounce back easier.

Again, as always, please reach out to me if you have any questions or concerns.

As with most businesses right now, we are operating almost completely via phone/email and video meetings. Please rest assured that we will continue to be operational and here to help.